Mining, quarrying, energy, industry and construction (COVID-19 monograph)

The COVID-19 pandemic in Spain. First wave: from the first cases to the end of June 2020

Monographs from the National Atlas of Spain.

Thematic structure > Social, economic and environmental effects > Economic indicators and productive sectors > Mining, quarrying, energy, industry and construction

Economic activities related to the secondary sector were also affected by the COVID-19 pandemic. The graphs showing the monthly evolution in the amount of workers affiliated to the Social Security system attest to this fact.

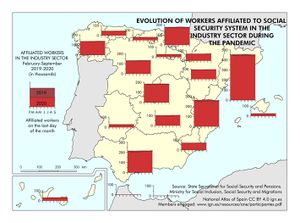

The reduction in output and its overall impact on employment was manifested in a trend –without exception– towards a contraction in the number of affiliated workers, although with uneven behaviour according to sectors. For example, the construction sector saw a sharp drop in jobs from March to June 2020, which bottomed out during strict lockdown in March and April. However, it was the only sector to rebound strongly in the following months, to the point that it recovered its 2019 employment figures by mid-August 2020. In the mining, quarrying, energy and industry sectors, growing exports were not enough to prevent a slight overall drop in employment. However, the mining and quarrying industry lost more jobs than others and continued to do so throughout 2020, with no change in sight at the end of the period. The job recovery expectations in the industry sector were somewhat better.

The maps on the Evolution in the amount of workers affiliated to the Social Security system show the negative impact of the pandemic on a regional scale. In the mining and quarrying sector, the regions home to the main active mining basins in Spain registered a slight decrease in the amount of affiliated workers in 2020. These included La Rioja, Galicia, the Region of Madrid (Comunidad de Madrid), the Region of Valencia (Comunitat Valenciana) and Andalusia (Andalucía). A similar decline was observed in the energy sector, more apparent in regions such as the Basque Country (Euskadi/País Vasco) and the Region of Madrid (Comunidad de Madrid). Likewise, the industry sector followed the same slight downward trend, very clear in regions such as Catalonia (Catalunya/Cataluña), the Region of Valencia (Comunitat Valenciana) and the Basque Country (Euskadi/País Vasco). Finally, the significant fall in building projects during the period assessed meant that the construction sector was the most affected. This explains why those regions with large metropolitan areas, such as Madrid (Comunidad de Madrid), Catalonia (Catalunya/Cataluña), the Region of Valencia (Comunitat Valenciana) and Andalusia (Andalucía), together with some of their labour exporting neighbouring regions, such as Castile–La Mancha (Castilla–La Mancha), fared worse than others.

-

Map: Evolution of workers affiliated to the Social Security System in the mining sector during the pandemic. 2019-2020. Spain. PDF. Data. Interactive version.

Map: Evolution of workers affiliated to the Social Security System in the mining sector during the pandemic. 2019-2020. Spain. PDF. Data. Interactive version. -

Map: Evolution of workers affiliated to the Social Security System in the energy sector during the pandemic. 2019-2020. Spain. PDF. Data. Interactive version.

Map: Evolution of workers affiliated to the Social Security System in the energy sector during the pandemic. 2019-2020. Spain. PDF. Data. Interactive version. -

Map: Evolution of workers affiliated to the Social Security System in the industry sector during the pandemic. 2019-2020. Spain. PDF. Data. Interactive version.

Map: Evolution of workers affiliated to the Social Security System in the industry sector during the pandemic. 2019-2020. Spain. PDF. Data. Interactive version. -

Map: Evolution of workers affiliated to the Social Security System in the construction sector during the pandemic. 2019-2020. Spain. PDF. Data. Interactive version.

Map: Evolution of workers affiliated to the Social Security System in the construction sector during the pandemic. 2019-2020. Spain. PDF. Data. Interactive version.

The graphs on the Monthly evolution in the amount of furloughed workers from March to September 2020 show significant numbers of furloughed workers in all production areas, with the numbers decreasing as the months went by. The graphs show that over 1,600 workers in the mining and quarrying sector were on furlough during the initial months of the year, with the number beginning to decrease in April 2020. The sector’s percentage share on the total amount of workers on furlough show little change throughout the period. In the energy sector, the amount of affiliated workers on furlough reached a maximum in April 2020 and then began to reduce, following the same dynamics. The industry sector registered the same trend, although the industry sector’s percentage share on the total amount of affiliated workers on furlough remained stable throughout the whole period. Lastly, the construction sector followed a clearly downward trend, both in terms of the absolute amount of affiliated workers on furlough and its proportional share on the total amount of workers on furlough nationwide.

- ""

The increase in the use of home office was especially significant in the industry sector, as shown on the graph on Companies using home office in the industry and construction sectors. Before the state of alarm, only 15% of industrial companies used this work format, yet these figures rose to around 60% during the period assessed. The construction industry followed a similar pattern, with the percentage rising from around 8% to nearly 40%. This way of working meant a qualitative change in the way industrial companies operated, and everything points to it being maintained in the future, albeit in a more regulated and proportional way after the pressure of the health crisis.

Lastly, the pandemic also had effects on production and turnover in these sectors. The Monthly evolution in the Business Turnover Index in the mining and quarrying and in the industry sector showcase this effect. Taking the 2015 figures as a reference, the year-on-year decrease from 2019 to 2020 was evident in both cases, mainly in March and April. The Business Turnover Index in construction sector showed a similar trend, yet a return to previous figures was observed from July 2020 onwards.

Co-authorship of the text in Spanish: Paz Benito del Pozo, María Carmen Cañizares Ruiz and Cayetano Espejo Marín. See the list of members engaged

- ASOCIACIÓN EMPRESARIAL EÓLICA (2021): Anuario Eólico. La voz del sector. Available in: https://aeeolica.org/comunicacion/publicaciones-aee/anuarios/4649-anuario-eolico-2021-toda-la-informacion-del-sector-en-el-ano-2020

- UNIÓN ESPAÑOLA FOTOVOLTAICA (2021): Energía Solar Fotovoltaica. Oportunidad para la sostenibilidad. Informe Anual 2021. Available in: https://unef.es/informacion-sectorial/informe-anual-unef/

You can download the complete publication The COVID-19 pandemic in Spain. First wave: from the first cases to the end of June 2020 in Libros Digitales del ANE site.